House Republicans have pushed through a major tax and spending bill backed by former President Donald Trump just ahead of the July 4 holiday. The wide-ranging package proposes permanent tax cuts, major increases in military and border enforcement funding, and overhauls to welfare programs.

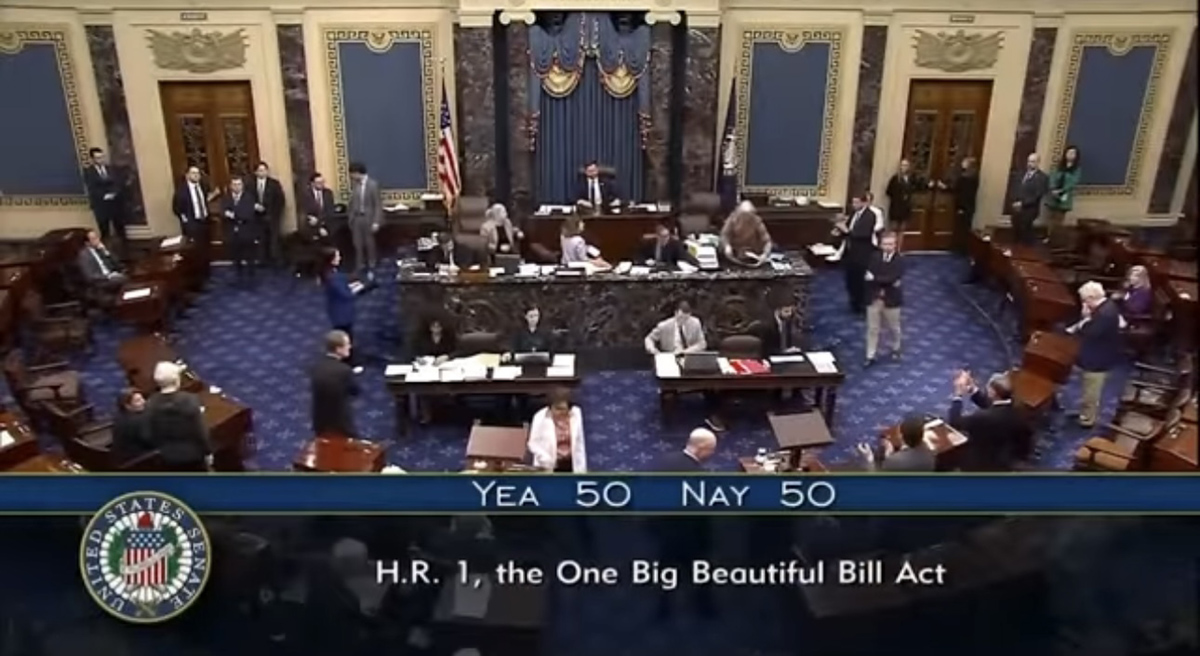

The bill passed the House narrowly on July 3 in a 218–214 vote. Two Republicans—Reps. Brian Fitzpatrick (R-PA) and Mike Gallagher (R-WI)—joined all 212 Democrats in opposing the measure. The outcome followed intense intraparty negotiations and a last-minute push by GOP leadership to lock in support.

If it becomes law, the bill would mark one of Trump’s most significant legislative victories ahead of the 2024 election.

What’s Inside Trump’s Tax and Policy Bill

The proposed legislation spans 887 pages and aims to make permanent the 2017 Trump-era tax cuts, which were originally set to expire after 2025. In addition to extending lower individual and corporate tax rates, the bill introduces:

- New deductions for tips and overtime pay

- An increase in the Child Tax Credit

- A temporary repeal of the $10,000 SALT deduction cap

On the spending side, the bill authorizes:

- $150 billion for border security, including increased ICE funding and expanded immigration detention

- $350 billion for military modernization and defense operations

- $25 billion in cuts to clean energy subsidies and climate programs

The bill also imposes stricter work requirements for recipients of Medicaid and the Supplemental Nutrition Assistance Program (SNAP). Individuals without dependents would be required to work at least 30 hours per week to retain eligibility.

Additionally, the measure raises the federal debt ceiling by $5 trillion, to allow borrowing through at least 2028.

Fierce House Debate and Party Clash

The bill faced intense opposition from Democrats, who labeled it a “giveaway to the wealthy” and a direct attack on the nation’s most vulnerable. House Minority Leader Hakeem Jeffries (D-NY) delivered a marathon 8-hour floor speech, warning the bill would strip vital services from working families while ballooning the national debt.

Despite internal rifts, Speaker Mike Johnson (R-LA) and Majority Leader Steve Scalise (R-LA) rallied enough GOP members, including holdouts from the House Freedom Caucus, to secure a majority. Some members were swayed by additions to the bill such as increased defense and border funding.

Economic Impact and Warnings From Experts

The Congressional Budget Office (CBO) estimates the bill could add $3.3 trillion to the national debt over 10 years. Critics also warn that the stricter eligibility rules for social programs may disqualify up to 12 million Americans from Medicaid and food assistance by 2034.

Supporters, including Trump and House Republicans, argue the plan will stimulate economic growth, reduce tax burdens for middle-class Americans, and prioritize national security.

The bill now heads to the Senate, where its future is uncertain. Senate Democrats have vowed to block the bill unless major changes are made. If it does pass, President Trump is expected to sign it during a high-profile ceremony on July 4 at the White House.